While the fight against COVID-19 continues in Thailand, the country is looking for ways to rebuild its economy following months of hardship. With tourism as its main source of revenue, Thailand is hoping to kickstart the economy thanks to its popular tourist destinations. To be able to reopen travel safely to international visitors, the Tourism Authority of Thailand (TAT) is launching an innovative scheme called the “Phuket Sandbox Program”. Let’s take a closer look.

What is the Phuket Sandbox program?

As a frontrunner in dream travel destinations, Thailand is hoping to welcome back international travellers with their newest campaign the “Phuket Sandbox program”, a scheme developed to encourage travel to the country while adhering to the safety protocol to protect the country and its citizens.

The aim is to open up Phuket to visitors arriving from low-risk countries who are fully vaccinated. Travellers must choose from a pre-set list of resorts and remain in quarantine at their chosen location for 14 days but with the ability to move freely around the resort. The campaign is planned to begin on July 1st 2021, subject to final approval depending on the assessment of several nationwide statistics on June 30th 2021.

What is the current COVID-19 situation in Thailand?

Before exploring what this reopening campaign means for local hotels, let’s take a quick look at the current COVID-19 situation in Thailand. Facing a state of a partial lockdown with inbound travel open, and outbound travel only partially open, as of May 30th 2021 the country has 162,022 active cases and has vaccinated 1,110,953 people, representing only 1.6% of the population.

Although the country’s own vaccination programme is relatively limited, leaders believe that they can safely welcome vaccinated travellers into the country with their carefully curated strategy. For the most current data, click here.

How has the market responded to the announcement of the program?

To understand the market reaction after the campaign announcement, we took a deep dive into data from BenchDirect, a free benchmarking platform by The Hotels Network (THN) that enables hoteliers to compare their hotel’s direct channel performance to the market and competition.

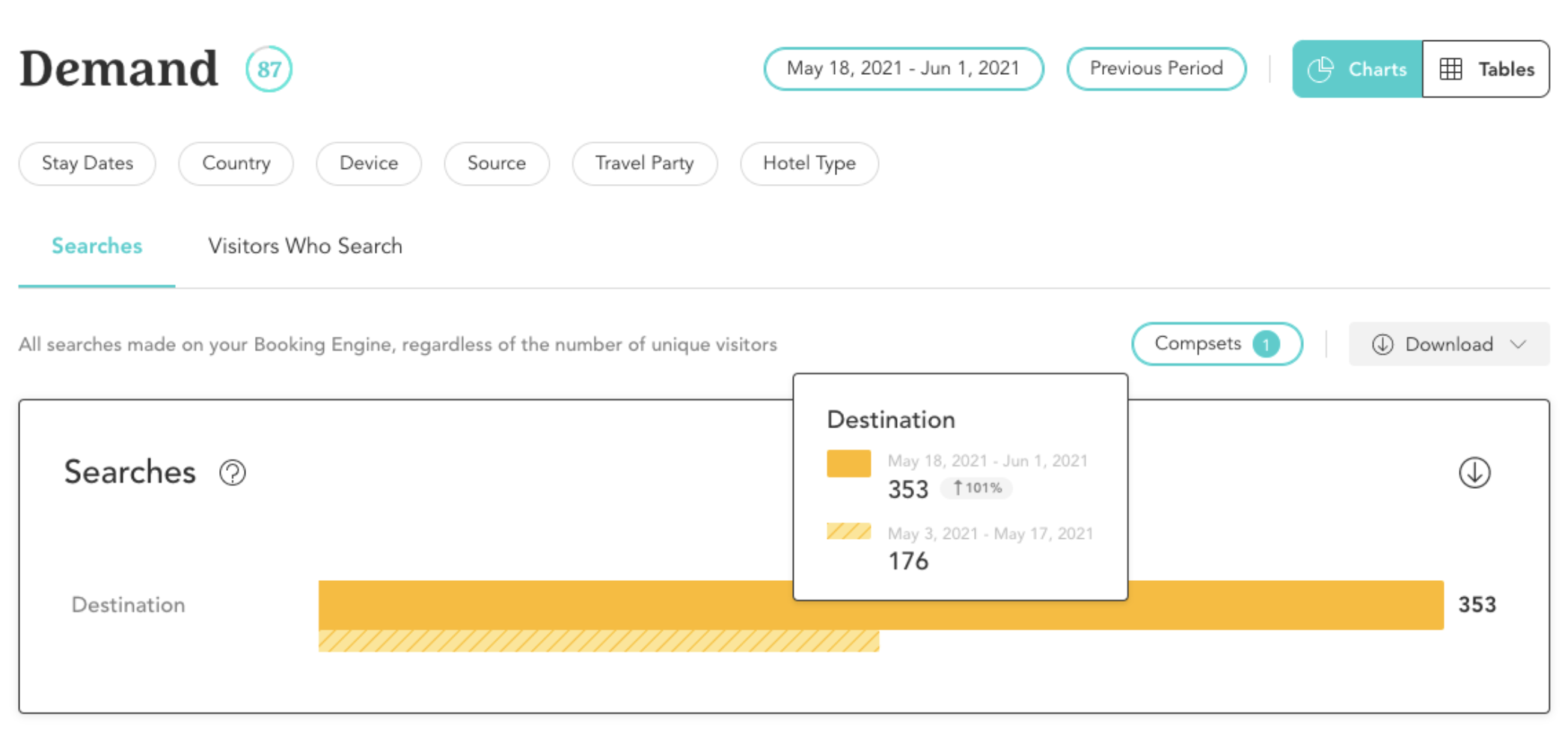

Within the tool, a hotel can compare its performance to multiple compsets. For the purposes of this study, the analysis looks at an example of a destination compset, which shows data based on visits to the hotel websites of THN’s clients located in Thailand. The insights provide an indication of trends in the market and help identify opportunities for hotels to capitalize on. The analysis compares the results of the destination compset from May 18th to June 1st 2021, the period when the announcement was made, to the 15-day period prior to the announcement, May 3rd to May 17th 2021.

Here, we explore four of the most relevant metrics to help gauge the impact of the announcement of the Phuket Sandbox program on hotel bookings in Thailand. To read the full report, click here.

Please keep in mind that this article was written on June 10th 2021 and so there may have been changes since then as the situation is constantly evolving.

1. Uptake of Search Demand

Since the announcement of the campaign, the number of searches made on the hotel websites within the Destination Compset have doubled. This suggests that since the Phuket Sandbox program was announced, there are significantly more people searching on hotel websites to book a stay in Thailand. We would expect this increase in demand to continue as more guests start to explore their options for bookings as of July 1st, which should translate to an increase in website traffic for hotels in the region.

2. Shift in Hotel Website ConversionBased on the analysis of the Destination Compset, we saw the overall website conversion rate increase by 17% - from an average of 0.6% to 0.7%. It is interesting to note, however, that booking engine to booking conversion decreased by 9%. This may be due to the fact that there are less qualified searches occurring on hotel websites, with visitors spending more time researching multiple hotels but with less urgency to book.

Quick tip: Total Conversion refers to all bookings divided by all unique visitors who landed on your website while Booking Engine to Booking Conversion refers to those users who made a search on your Booking Engine and ended up booking a stay at your hotel.

3. Increase in Price Disparities with OTAs

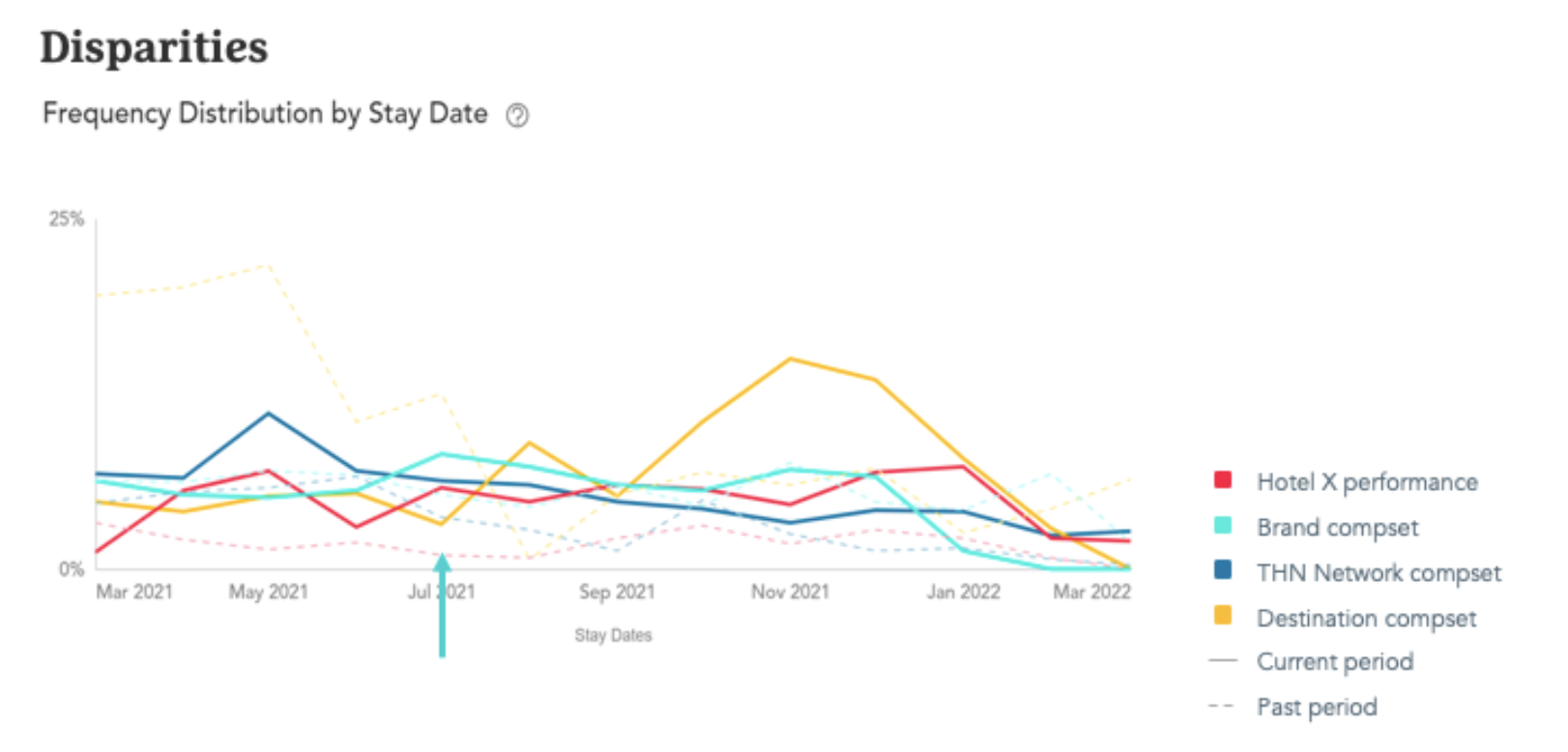

Destination compset price disparity frequency %

Destination compset price disparity frequency %

Here, we are analyzing the disparity frequency by stay date. Taking the last 30-day browsing dates (April 28th to May 28th) with stay dates from May 2021 to March 2022, and comparing it to the previous period, we see that there has been a clear increase in price disparities between hotel rates and OTAs.

The turquoise, blue and red lines indicate the THN compset, hotels within the same brand and the hotel in question respectively. The yellow line, which represents the destination compset (hotels in Phuket), is showing a significant jump in price disparity frequency compared to the hotel and other compsets. OTAs listing hotels in the region are quickly adapting to this new announcement and are offering better rates than those offered on the direct channel of the hotels in order to capitalize on the growing demand.

4. New Important Source Markets

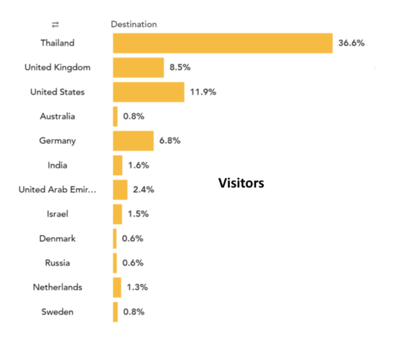

Hotel website visitor origin for Destination Compset

When looking at the origin of visitors who are searching on hotel websites in Phuket, we observe an entirely new picture compared to what Thai hoteliers were used to. For stays in the next 90 days as of June 3rd 2021 we can see that the top website visitors are the domestic market as the frontrunner with 36.6% of the traffic searching from locally, followed by the US with 11.9% of the visitors, UK with 8.5% and Germany with 6.8%.

How can hoteliers adapt to this new situation?

As a hotelier, understanding the ways in which the market and travel has changed is key in order to make sure you are prepared for this initiative and capitalize on the opportunity.

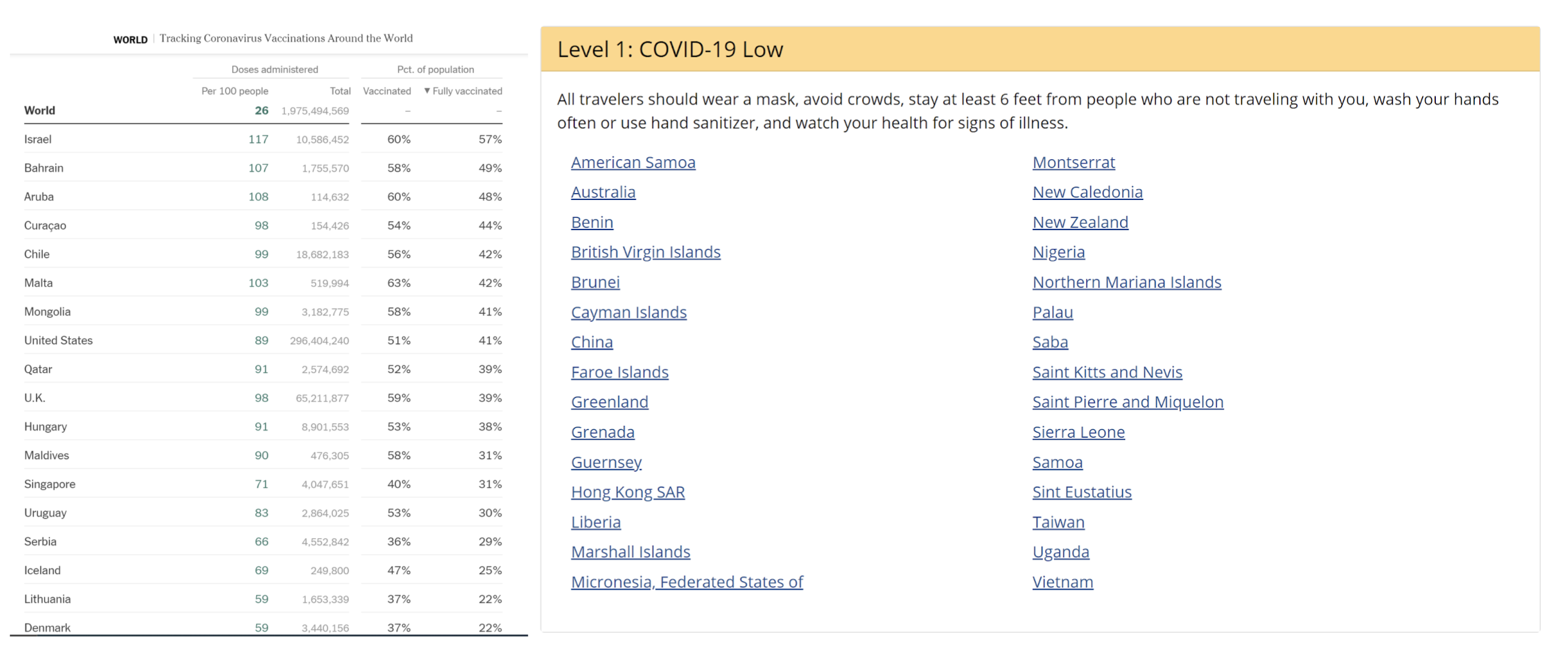

One of the biggest areas to consider is the clear shift in the top markets. While Thailand used to welcome travellers from countries such as Russia, China and Australia, the focus now is on the highly vaccinated and low risk countries such as the UK and the US. So, combining these data - countries with a high % of vaccination with low risk areas - is needed in order to gain a better picture of who hoteliers should be targeting, allowing them to reassess who their real audience is and shift their offers towards these new markets.

Countries with the highest vaccine number (a study by New York Times) vs Countries with the lowest number of Covid-19 cases (from US CDC)

While this campaign is targeted towards international travellers, it is important to keep in mind the local traffic that this campaign will attract as well.

It also makes sense for hoteliers to rethink their pricing strategy to be able to compete against OTAs and remain relevant within the travellers’ consideration set. Hoteliers should always ensure they are offering the best available rate, and clearly communicate this across their hotel website. What’s more, to attract and engage these potential visitors, it’s time to get creative and offer enticing deals and benefits to make sure visitors have an additional reason to book directly.

In short

With signs of recovery in sight, it is essential for hoteliers to be proactive in their preparations for any travel that may be headed their way. In this article, we provided a summary of how this campaign is impacting hotel booking trends and identified several key factors for hoteliers to take into consideration when reopening. To access the full guide with a more comprehensive analysis, click here. By using these types of insights to spot opportunities and take relevant actions, hoteliers can set themselves up for success as more campaigns such as these continue to be introduced to the market.

Taking it one step further, hotels can not only monitor the evolution of the current market situation but also benchmark their own hotel’s performance against the market and other competitive sets. With the launch of BenchDirect, benchmarking insights focusing on the direct channel are now available to hotels in Thailand, and the rest of the world, at no cost. Request a free account for your hotel brand today and join our global network of 12,000+ hotels who are already happily benchdirecting.